March 19, 2021

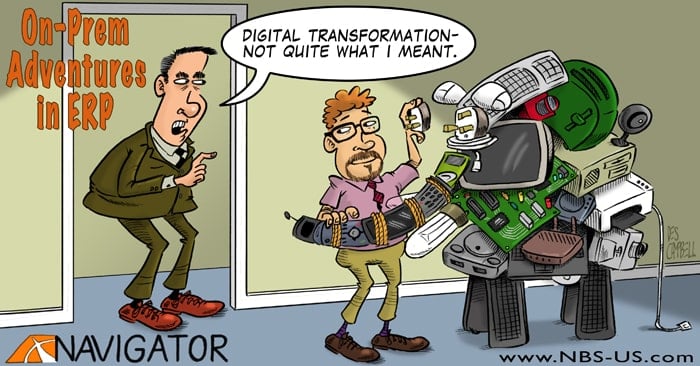

ERP Helps CFOs with Digital Transformation

The race to digitally transform business operations has created new goals and challenges for many chief financial officers. Executives are under pressure to transform outdated systems and improve digital connectivity in a cost-effective manner. But that’s a tall order.

Modern enterprise resource planning solutions (ERP) provide a clear path to digital transformation for these businesses, facilitating productivity and efficiency gains. They can also help improve processes and operations across teams, and have a lasting impact on the entire company culture.

A recent paper in the Journal of Accounting & Organizational Change, CFO Characteristics and ERP System Adoption, analyzes the relationship between CFOs and ERP adoption. The paper examines several factors that may influence adoption, including age, education, tenure, and recruitment influence.

The study concluded that businesses with externally recruited CFOs have a higher rate of ERP adoption than those with internally promoted executives partially because those brought in were less tied to what came before. Previous studies cited by the research also indicate that CFOs have a higher impact on ERP system implementations in most companies than other executives and that the finance module ultimately determines whether an ERP solution will get deployed.

CFOs drive digital transformation, in other words.

ERP Offers a Path Forward for Pressured CFOs

The decision to move forward with a modern, cloud-based ERP system can seem daunting for many CFOs and finance teams. Yet ERP offers a clear path to digital transformation by removing the silos that exist with outdated, manual systems and processes. Data integration, scalability, flexibility, and the facilitation of communications and collaboration are just some of the many benefits ERP affords businesses.

Finance departments can realize specific, concrete benefits from ERP systems as well. For instance, many CFOs are under pressure to provide real-time business insights while also increasing transparency in accounting practices. ERP platforms like SAP S/4HANA Cloud Public Edition provide that real-time data, while also lowering transaction costs and optimizing working capital. A cloud-based ERP solution will also be a valuable asset for meeting regulatory compliance mandates and can provide automated, innovative insights for better finance optimization

In terms of transparency, cloud-based ERP platforms provide a unified view of accounting practices that are available to all departments and business groups. Increased visibility along with embedded analytics and dashboards facilitate discussion and collaboration throughout a business and beyond, making ERP a valuable communications and collaboration tool.

Using ERP to support growth and innovation

Businesses of all sizes are under pressure to expand revenue opportunities and foster innovation. CFOs are at the helm of those initiatives, putting even more pressure on finance executives to meet evolving business requirements quickly and efficiently.

Small and mid-sized businesses face extra challenges since they often work with limited staff and resources. Smaller businesses also need flexibility and scalability to accommodate the pace of change while offering a secure path forward.

A comprehensive cloud-based ERP solution offers targeted features to aid in the process. One of the key features of these types of solutions is the ability to link all processes across the value chain. That means all business transactions are automatically updated and available to all departments for reporting, accounting, and finance purposes. Automation and built-in analytics help smaller companies make better decisions. Valuable data may also be used to set and achieve company goals while fostering innovation.

The automation component of ERP is useful for businesses of all sizes. Financial value chain operations like payment reminders and electronic bank transfers and statements may all be automated and optimized. Similarly, financial processes may be quickly and easily changed to improve efficiencies and encourage innovation.

The result of a successful ERP implementation will be cost savings, increased productivity and efficiencies, and overall improved satisfaction with the accounting and finance department practices.

CFOs are already getting on board with the benefits of ERP. According to the journal study referenced earlier, 210 of 296 CFOs said their company had adopted an ERP system, predominantly SAP systems. Those who have yet to adopt an ERP system have some catching up to do.

As previously mentioned, externally hired CFOs are more likely to have introduced ERP systems. According to the researchers, "One reason for hiring external CFOs may be that they bring in knowledge on ERP system implementation and are sometimes also expected to lead such projects. Alternatively, it may be that the respective firm has already decided to adopt an ERP system and hires an external CFO because of his or her experience in ERP system adoption to drive the ERP system implementation."

In other words, ERP projects are good for career advancement because leading an ERP project reflects well on CFO competencies.

Even if that is not a personal factor for a CFO, the benefits of a modern ERP system are compelling for most CFOs. Not only do they offer clear benefits to finance and accounting teams, but they also provide a much-needed path forward to digital transformation for the entire company. By fostering innovation and collaboration while also creating transparency and breaking down silos among teams and departments, ERP solutions are an important digital stepping stone, and one every CFO should consider.

To learn more about the process for implementing an ERP from a CFO perspective, download our free ERP Implementation Guide for CFOs.