When QuickBooks is Not Enough

Along with the success of a growing business comes the added responsibility of staying competitive and up-to-date with the latest advancements in business technology. Programs like Excel and QuickBooks are great for helping small businesses manage project details and accounting on a smaller scale, but what happens once your business outgrows these solutions?

You may feel more comfortable sticking to the old ways since you are familiar with your accounting system and are apprehensive about investing time and resources in adopting a new system. By breaking free from reliance on the old system, however, you can radically improve the financial management and reporting of your business and lay the foundation for continued revenue growth even as your company scales.

So when is the right time to make the switch? Here are some instances where you may want to consider moving off "Simple Accounting" QuickBooks and onto a more robust ERP solution:

- Your business is expanding into multiple markets and locations.

- You have begun hiring more employees to take on sales and order fulfillment roles.

- Your business needs a more comprehensive business management system.

- Your business needs improved reporting.

- Your business offers multiple sales channels and would benefit from an integrated system.

- Your business is preparing to sell globally and needs multiple currencies.

- The current system is ineffective and is incapable of managing an increasing amount of data.

- Your business earns between $25 million and $500 million in annual revenue.

- Your business is involved in retail, manufacturing, wholesale distribution, service or consumer package goods.

[Blog] Why Cloud ERP favors Business Below Large Enterprise

Why Switch to ERP

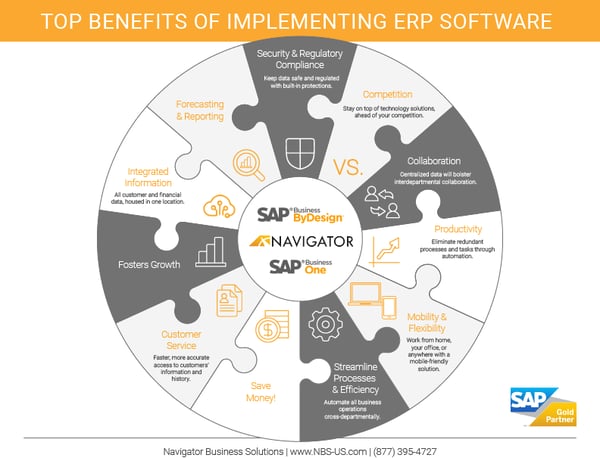

A cloud-based ERP offers fully integrated system that allows you to view and manage every aspect of your business operations, tying accounting to the rest of your company’s operations.

With ERP, unlike QuickBooks, you get inventory, distribution, sales management, bookkeeping, and more all in one place, saving you time and resources. With access to customers, operations, people, and data in the cloud system, you will be able to have a leg up in the market, while increasing versatility and financial security.

For instance, ERP allows you to monitor every step in the sale cycle in real-time, from initial quote to final payment without having to consult several different applications or pull data from multiple reports.

Financial trends are easier to spot, too, because ERP comes with robust analytics and reporting capabilities. With ERP, you can quickly uncover trends and insights, revenue sources and under-performing products, helping you construct a detailed financial picture both of your company’s financial operations and industry trends that might affect future revenue growth.

Bringing together information also is easier, because ERP is a single system for your entire business. Cloud-based ERP systems enable real-time quote management, sales data, inventory and customer history automatically so all financial data is in one place and data entry is minimized.

In short, switching over from QuickBooks or Excel to an integrated ERP solution is a big step toward achieving a more in-depth, broad scope for your business. With this faster and more effective approach, you will be able to better anticipate change, quickly find solutions, and grow your business even in today’s ever-changing environment.

QuickBooks is a Good Start, But There’s a Next Step

This is not to imply that there’s anything wrong with QuickBooks. There’s definitely a time and a place for QuickBooks, especially for smaller businesses and those just starting out. As your business grows, however, the limitations of small-business accounting software will become apparent as you scale and require deeper, more complete analytical and financial management.

QuickBooks is a fine standalone accounting package, but it doesn’t scale when a company develops complex supply chain operations, expands to include multiple countries or product lines, or takes on staffing in the hundreds.

Businesses that sell online also will want a solution that better handles integration with online stores and third-party marketplaces and delivers deeper financial automation.

There’s a reason that small businesses choose QuickBooks—and then graduate to a more robust financial management solution like cloud-based ERP.

So if your business is feeling the pain of accounting software that can’t keep up, or you’re just looking down the road for a solution that scales along with your business, there’s a solution: ERP.

Migrating from QuickBooks to an ERP solution also need not be challenging. We’ve put together a list of five mistakes that SMBs typically make when migrating from QuickBooks to an ERP system, and we can help your company make the jump.

ERP provides the tools that can help take your business to the next level, and that will give your business plenty of potential for improvement in all aspects of your company. So when you’re ready, there’s a next step beyond QuickBooks.

For more information, download our ERP Implementation Guide for CFOs or contact us at (801) 642-0123 or info@nbs-us.com.